The oracle that’s Standard Life is telling us that “78% of people in the UK want income certainty in retirement, while many are also worried about running out of money in the future”.

Alongside this, they confirm “annuity rates have risen by over 20% during the last 12 months and people are generally living longer – and, with 1 in 4 men aged 65 today likely to live until they’re 92 (or 94 for women), it’s getting harder to predict how long your client’s pension savings will need to last”.

So, you definitely need an annuity then.

What is an annuity?

An annuity is the tried and tested method of providing an income in retirement. It remains the case that no other option at retirement offers a level of income that is guaranteed to be paid however long the individual lives for.

Let’s clarify a few points first.

- Have you sorted your future lifestyle spending between required, desired and aspired? If you have, how certain do you want to be about covering at least the required and desired spending?

- Annuities can be purchased or certainly considered, usually from aged 60 onwards. There’s a good body of evidence that suggests, particularly if your health is good, you may get better value from deferring any annuity purchase until your late 60s.

- You can use parts of your accumulated pension to buy an annuity at any stage, after reaching the minimum age, this is most definitely not a “one and done” exercise.

- Full medical disclosure to ascertain if you may benefit from higher annuity rates is an absolute must, do not proceed without doing this!

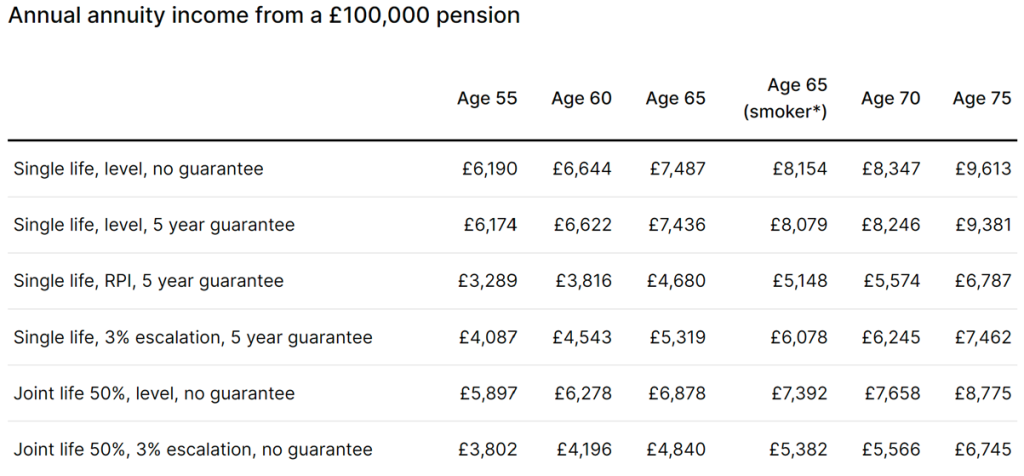

The table below provides a snapshot of current annuity rates (thanks to Hargreaves Lansdown) and assumes £100,000 was used in this exercise.

Further clarification around some of the terminology used.

Single Life – An annuity that ends on your sole life.

Joint Life – An annuity paid until both named individuals die.

Guarantee – The annuity is guaranteed to be paid for a minimum period after commencement e.g. If death occurs in year 2 of a 5-year guaranteed annuity, three years of annuity payments would be made to your estate.

Level – The annuity would never increase, unlike 3% or RPI which signify how the annuity would increase each year.

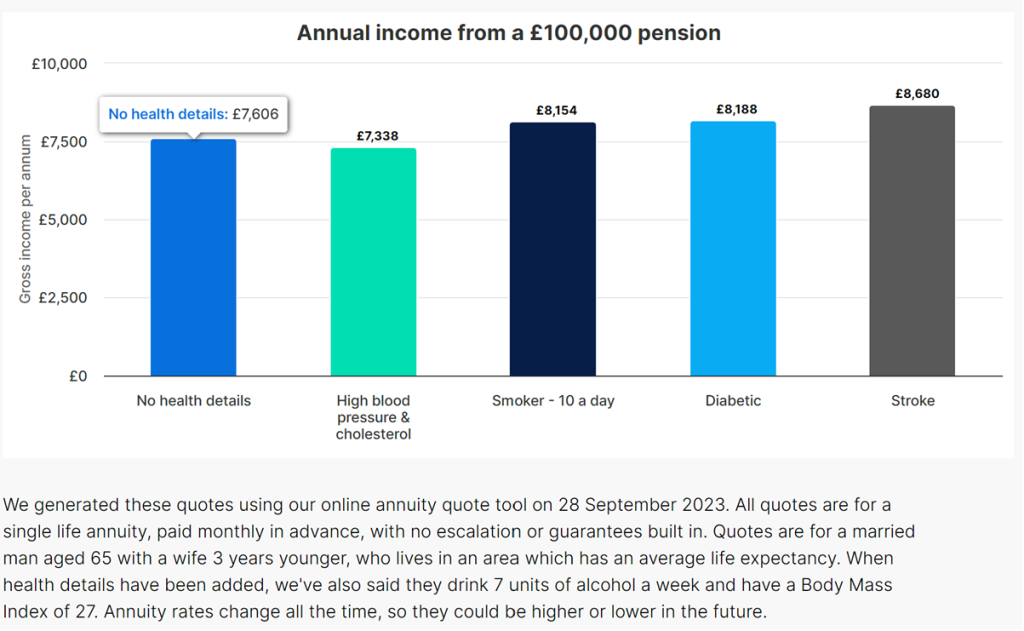

Cross reference these figures with the table below which provides indicative figures for the same £100,000 pension (male aged 65), this time with some declared health conditions.

Key points:

- Assume inflation at 5% per annum, taking a £7,500 income which doesn’t increase each year gives you approx. £4,600 purchasing power in 10 years’ time i.e., your income has declined by approx. 39% over 10 years!

- Annuities can be purchased with 10 or 20 year guarantees if you are concerned about early death and the loss to your estate.

- Do not be blindsided by the highest single life non-indexed annuity rates if you have a spouse and think he/she will be fine if anything were to happen to you. I’ve seen this go badly wrong too many times.

- If you have used £100,000 of pension fund to purchase an annuity (non-increasing) and your Gross (pre-tax) income is £7,500 per annum, let’s assume you pay income tax at 20% on this annuity income, so your net (after tax) income becomes £6,000. The sums are simple, but you’d need to live for approx. 17 years to breakeven (income payments = pension used). This breakeven period can be longer if you elect for an annuity with some form of regular increase.

- If you’re leaving your pension fund invested, drawing “income” or regular payments from your pension and you’re a low to medium risk investor, have you considered alternatives? Might the certainty of an annuity be worth considering

- Let us stress, annuities can be considered and used as part of your future lifestyle funding, this should never be an all or nothing exercise.

Note about this article

This guide is for information purposes and does not constitute financial advice, which should be based on your individual circumstance.

A pension is a long-term investment, the value of your investment and the income from it may go down as well as up. Your eventual income may depend upon the size of the fund at retirement, future interest rates and tax legislation.

Please note that once your annuity commences payment it cannot be altered or amended in anyway and the terms that have been applied will remain for the rest of your life.

Second opinion service

We often seek out more than one perspective for matters of health. The same common-sense advice can apply to financial health as well. That’s why we offer our second opinion service.

If you, your family or close friends could benefit from a fresh perspective, please let us know in the form below. Any information you share with us will be treated with the careful handling it deserves.

At a second-opinion meeting, we’ll assess where you are now, where you want to go, and the best ways we see to close that gap. If you could potentially benefit from working with us, we’ll say so. If we find you are already on the right financial path, we’ll tell you that as well.

To ask a question or arrange a second opinion meeting, please complete the form below or call 01825 76 33 66.