Historically, many UK investors had portfolios which were very biased towards shares listed in the UK. This could have been due to several factors;

- Familiarity with UK listed shares

- Additional costs for investing overseas

- Struggling to access all overseas stockmarkets

Today, this has all changed.

Investing in multiple countries can deliver more reliable outcomes over time, helping you stay on track toward achieving your long-term goals.

Ignoring global markets means you may miss out on a wealth of opportunities.

Is it as simple as replicating the investment strategy you have for the UK? Will the UK stockmarket mirror the Japanese stockmarket in the future?

The short answer is we certainly hope not, as investors in Japan have experienced very disappointing longer term returns, but the truth is we don’t know and we don’t believe others can know in advance either.

Why is this important?

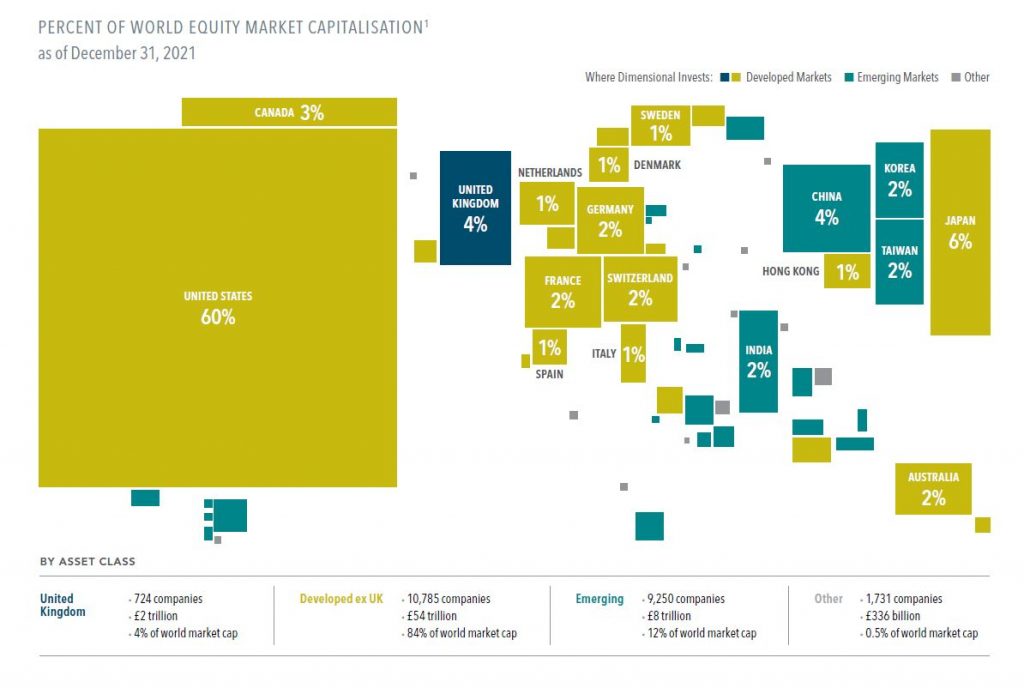

- Stocks of the roughly 21,800 companies trading outside of the UK represent nearly 96% of the world’s £65 trillion equity market.

- When determining where to invest, a country’s size, population, or gross domestic product may not be a primary consideration. Japan, for instance, is relatively small in landmass but accounts for 6% of the world’s equity market value, representing more than 2,500 companies, including familiar names like Toyota and Sony. Even a smaller country like Switzerland is home to publicly traded giants like Nestlé and two of the world’s biggest pharmaceutical firms.

- A strategy focused on global diversification captures returns from thousands of companies around the globe and can potentially offset weak performance in one market with stronger returns elsewhere.

There is no reason whatsoever why anyone should not look to own a properly and sensibly diversified global portfolio. Not to do so simply results in investment portfolios that are too dependent on the fortunes of single countries or continents.

Investment opportunities exist all around the globe and it’s hard to know where next year’s best returns will appear. A globally diversified portfolio can help capture a broad range of returns and deliver more reliable outcomes over time.

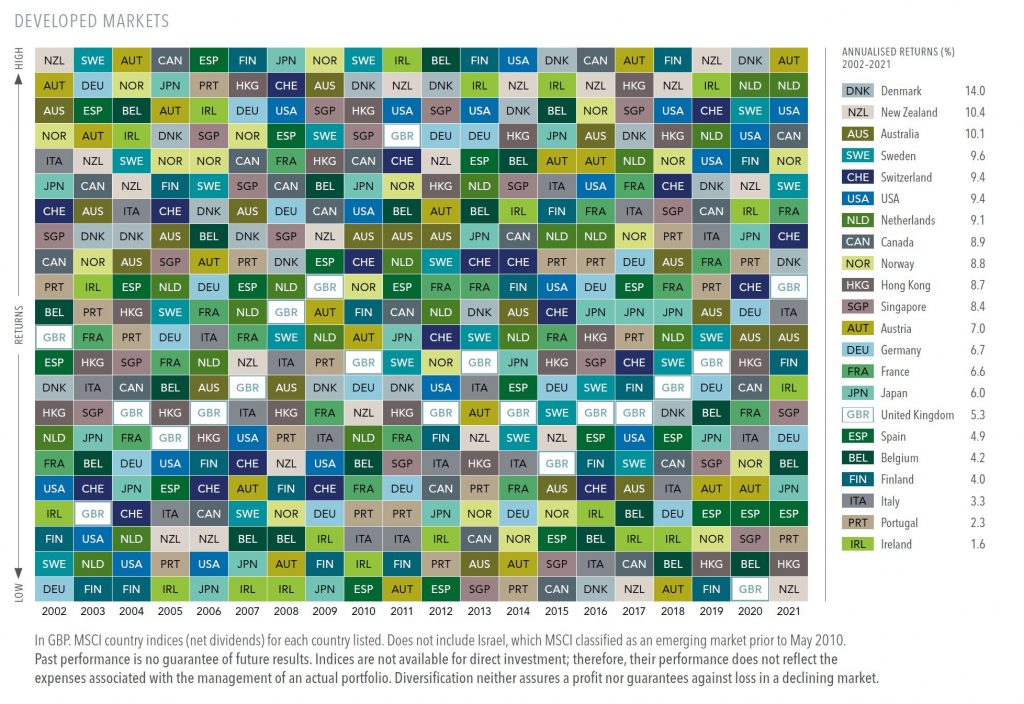

It is difficult to predict future returns by looking at the past, as shown by the performance of global markets since 2002.

- The table above powerfully demonstrates the randomness of global equity returns. It illustrates 20 years of annual returns in 22 developed markets. Each colour represents a different country. Each column is sorted top down, from the highest-performing country to the lowest.

- The scattered colours suggest it is hard to predict which country will outperform from one year to the next. Austria, for example, posted the highest developed market return in 2017 but the lowest the next year.

- Investors holding equities from markets around the world can have a more consistent investment experience, with higher returns in one market helping offset lower returns elsewhere.

If you are concerned about the diversification of your investment portfolio or have a question relating to this article, please get in touch. Either complete the form below or call us on 01825 76 33 66.

Source: Dimensional