Most of us have accepted the situation we’re now in and have adapted to a ‘new normal’.

The bulk of the world is in lockdown (official or unofficial) and we’re treating this threat seriously. We’ve seen unprecedented government support which will benefit those most in need, and see us get through this unprecedented period. We are also reminded of how important our family and friends are, be it spending most of our days with them or keeping in touch with them virtually.

As the virus spreads, it’s clear we’re all equal. This virus does not discriminate between background, religion, vocation, political affiliation, or net worth.

This crisis has revealed that there are no real global borders. We’re all connected, and this virus doesn’t need a visa.

A quote adapted from ‘That Scottish Play’:

“I have walked so far into this river of blood that even if I stopped now, it would be as hard to go back as it would be to continue”. William Shakespeare.

In these testing times our materialistic culture has been exposed for what it is, excessive and arguably unnecessary. It’s clear that we can survive with just the essentials: shelter, food, water and medicine. The luxuries have been a powerful story we’ve told ourselves. Where we were once concerned with brands, we’re now focused on simple commodities such as pasta, coffee, and shampoo.

We’ve seen that commentators with the loudest doomsday narratives catch the media’s attention. If they claim to know the market is heading further down, we wonder how vocal they were before this crisis?

Failed investors continue to make investment decisions based on economic news. Successful investors continue to make investment decisions based on tried and tested principles and practices aligned to a long term financial plan.

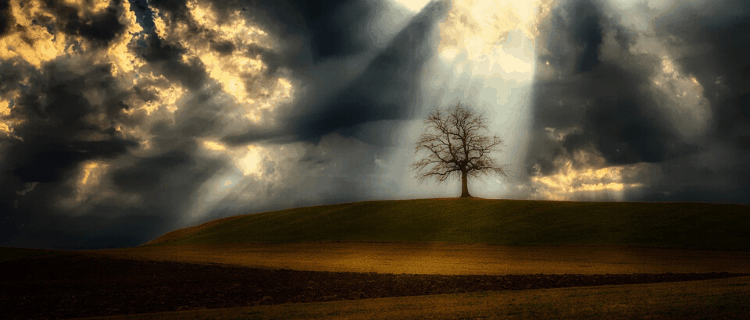

We still don’t know where the market will be heading. If anyone claims they do, remember this is a lie and not an untruth. We’re still relentlessly committed to our financial plans and in turn the investment portfolios that’ll fund them. All of our clients have shown ‘faith in the future’ by committing to staying invested, not changing a perfectly set up portfolio on the first sign of the storm and not getting knocked off-course by the mainstream media whose main job is to report negative news.

N.E.W.S – Negative Events World Service.

Have the darkest investment market clouds passed? We don’t know, but it would appear that the global markets have ‘stabilised’. Most of the impatient money seems to have left the market. We’ll refer again to one of the wisest investment quotes:

“The stock market is a device for transferring money from the impatient to the patient”. Warren Buffett

This market decline has broken many records but we can’t allow it to break any perfectly crafted long term financial plans.

Discretionary spending

Having completed lots of spending plans (budgets) with client families over the years, it’s always been a challenge to separate out essential spending from discretionary spending. Discretionary spending is spending on the finer things and experiences in life. Eating out, holidays, theatres, and clothes to name a few.

This is an opportune time to assess your spending plans. Remember, stock market sales are the exception and not the norm.

“Whatever comes out of these gates, we’ve got a better chance of survival if we work together. Do you understand? If we stay together we survive”. Maximus (Gladiator)

As always if you wish to discuss anything, please get in touch. All our meetings are now being held remotely.