Our traditional first topic of the year, revisits the subject of predictions and the problems of forecasting.

12 months ago, we asked our readers to give us their best guess (forecast) for the following:

- The closing value of the FTSE 100 Share Index

- 31/12/2021 – 7384

- 31/12/2022 – 7451

- The closing value of the S&P 500 (US Share Index)

- 31/12/2021 – 4766

- 31/12/2022 – 3839

- The total return (Index increase plus any reinvested dividends) of the FTSE 100

- 2021 Total return 18.44%

- 2022 Total return 4.70%

- Bank of England Base rate

- 31/12/21 – 0.25%

- Current Interest rate – 3.50%

- UK inflation rate

- 2021 approx. 5.1%

- 2022 approx. 10.7%

- The price of Bitcoin

- 31/12/2021 – $46,306

- 31/12/2022 – $13,662

- The price of Gold

- 31/12/2021 – $1,817

- 31/12/2022 – $1,823

- The top performing asset (Property, Shares, Cash etc…)

- 2021 Global Property shares 41%

- 2022 Commodities (Oil/Gas/Gold/Copper/Silver etc..) 30%

Whilst some readers came close to correctly forecasting the price of Gold and the closing value of the FTSE 100, no one predicted the huge spike in inflation, the accompanying rise in Bank of England Base rates, the collapse of Bitcoin and the best place to invest your money in 2022 (Commodities with a 30% return).

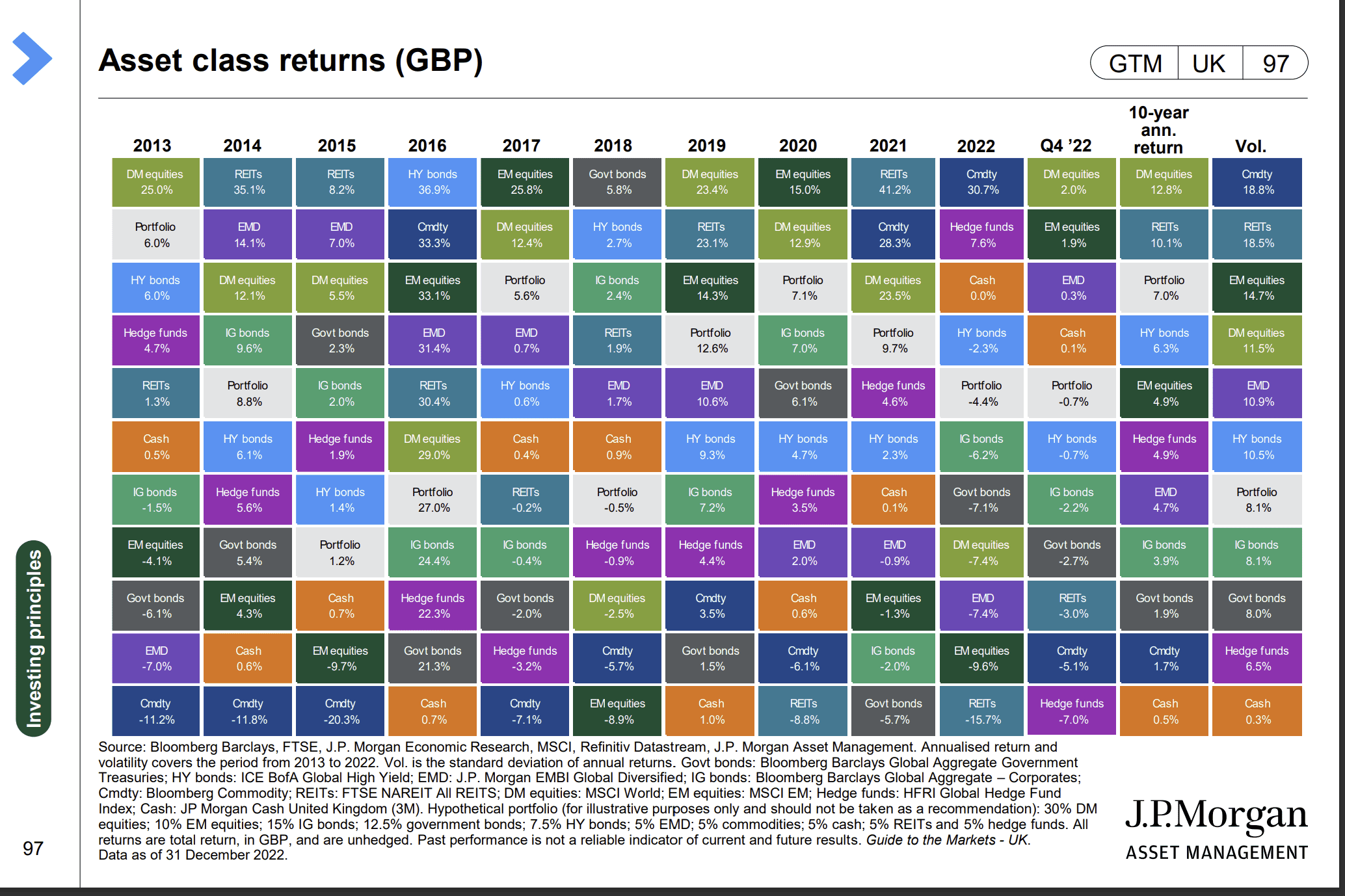

If you thought predicting where to invest over 1 year was hard, take a look at the patchwork quilt below (click on the image to view detail) and see if you can distinguish some trends and patterns from the best place to invest your money in each of the last 10 years.

Don’t be disheartened, this has proved beyond the vast majority of finance experts and investment managers as well, so you will be in good company.

Please send us your forecasts for 2023 and we’ll repeat the same exercise in 12 months time.

In the interim, stop the crystal ball gazing, follow the evidence and discover how to invest in a time-tested manner.

If you have a question about your investments, please get in touch.