Ensuring you are making the most of all of your tax allowances within a fiendishly complex overall tax system is always a challenge.

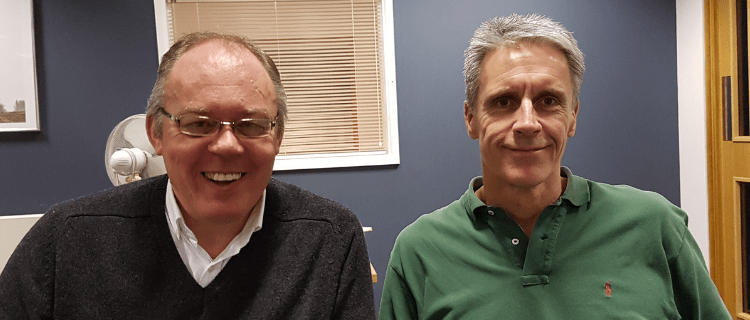

Hence why in our latest podcast, we are talking with Robin Stevenson (Head of Private Clients at Swindells Accounting) about how to make sure you’re maximising all of your available tax allowances in the run up to the end of the 2018/2019 Tax Year.

If you don’t have time to listen to the full interview, fast forward to the question that you are particularly interested in:

00:50 – Maximising personal Income Tax allowances – planning around tax thresholds

03:45 – Maximising pension contributions

06:45 – Dividend Allowance planning – Tips for the new and reduced £2K per annum allowance

09:50 – Capital Gains Tax planning

17:25 – Using Capital Losses to offset Gains

18:05 – Inheritance Tax – making gifts

20:00 – Making exempt gifts from excess income

22:53 – Record keeping using the IHT 403

25:25 – Tax Efficient Investments – ISAs, Insurance Bonds, EISs & VCTs

Or save the podcast to listen later, simply click here and ‘save as’ to file.

If you have a question about tax allowance, please get in touch.