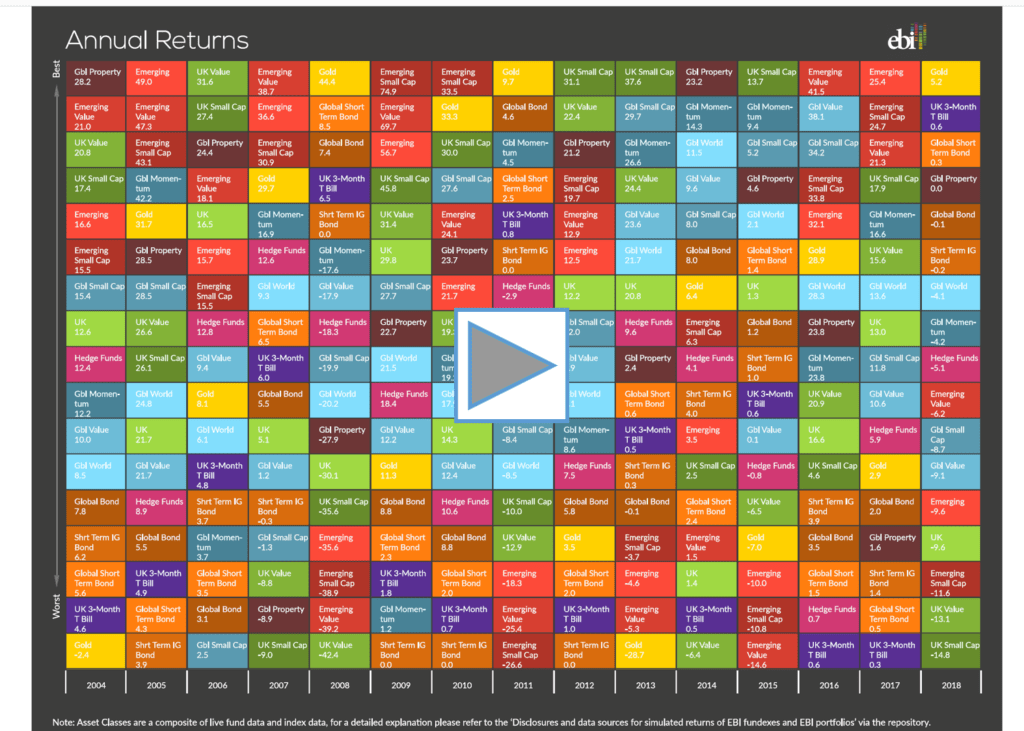

Legendary Nobel Prize winning economist Harry Markowitz called diversification “the only free lunch in finance”, in other words, by properly diversifying when investing, you, the investor, get the benefit of reducing risk while sacrificing little in expected returns over the long term.

The polar opposite of diversifying is concentration risk when investors typically have portfolios biased towards countries, the so called Home bias, towards sectors or industries, or to specific and individual shares.

Click on the image below for a short clip that provides the evidence in favour of diversification and why we advocate a true “Global” approach when investing, as well as highlighting the obvious pitfalls and perils if you attempt to forecast or crystal ball gaze.

If you have a question about your investments, please contact us on 01825 76 33 66 or send us a message.