Back in 2008, Standard Life launched their GARS (Global Absolute Return Strategies) fund with a great deal of hype and fanfare.

Its stated aim was to be an ‘all-weather’ fund solution that would perform well irrespective of overall market conditions. A tough challenge as we know the future is always uncertain.

The fund managed to meet its performance targets between 2008 and 2015, and increased in size to a barely believable £53000000000 (£53 billion) by 2016 (investor warning signal – lots of money chasing the latest ‘hot’ fund solution)

Given this overall size, there’s a fair chance many of you may have been investors, knowingly or unknowingly, at some point.

So, what happened to this brilliantly marketed ‘ideal’ fund solution?

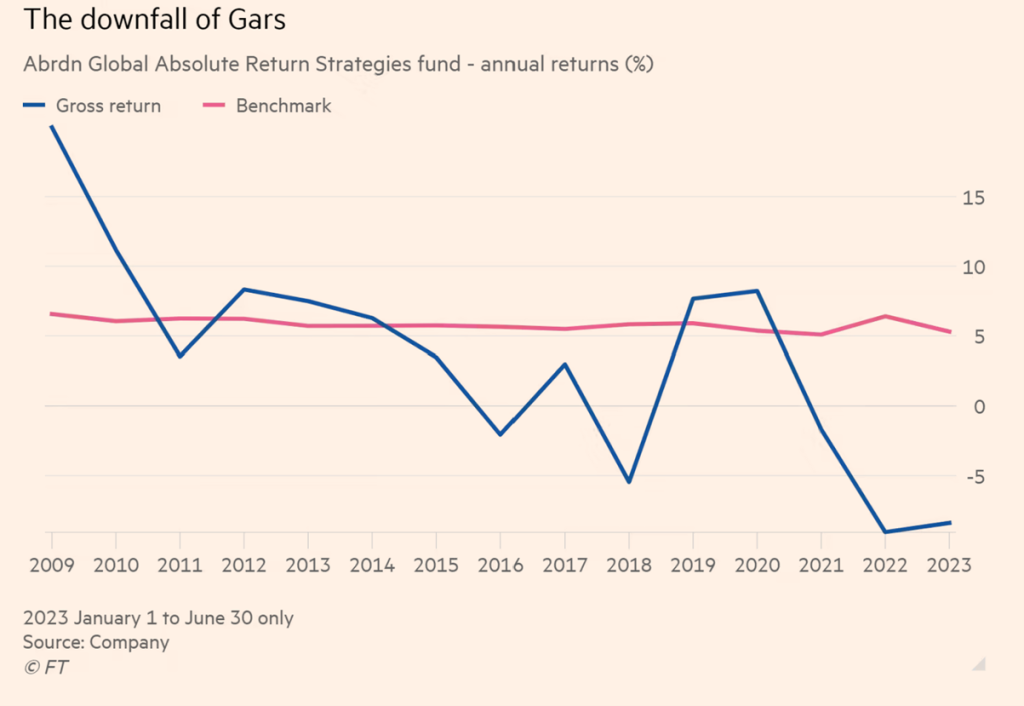

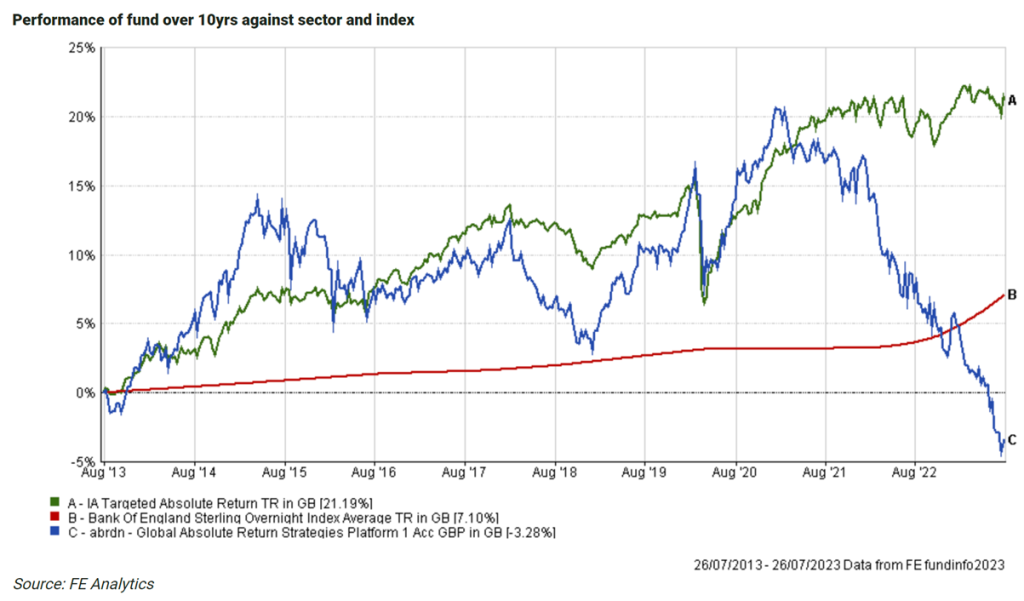

Take a look at these two charts and focus on the date’s axis and the dark blue line in both charts.

This chart exposes how poorly GARS ultimately performed when measured against its peers, cash or inflation.

As performance nose-dived, investors fled, and assets now amount to approximately £1.4 billion.

We could write endless paragraphs on the complex investment strategies (which we doubt most investors even understood) within GARS, but this is arguably yet another example of “if it sounds too good to be true, then it probably is”.

Abrdn (new owners of Standard Life) have announced the fund will be closing (without any mention of the gargantuan investment management fees that were taken during GARS tenure and seven consecutive years of dismal investment returns) and its history will be another chapter in the “should never have invested” manual.

What is the general lesson for investors?

There are plenty of other fund solutions currently attempting similar things to GARS, not to mention the thousands of other funds with brilliant marketing messages and cherry-picked performance numbers, that need urgent reviewing and analysing.

If you’re not 100% sure what your current investment or pension strategy is or it can’t be explained easily to you, then chances are, somewhere in your portfolio, you may have something similar to GARS.

If you are concerned about your investments, please get in touch by either completing the form below or calling us on 01825 76 33 66.