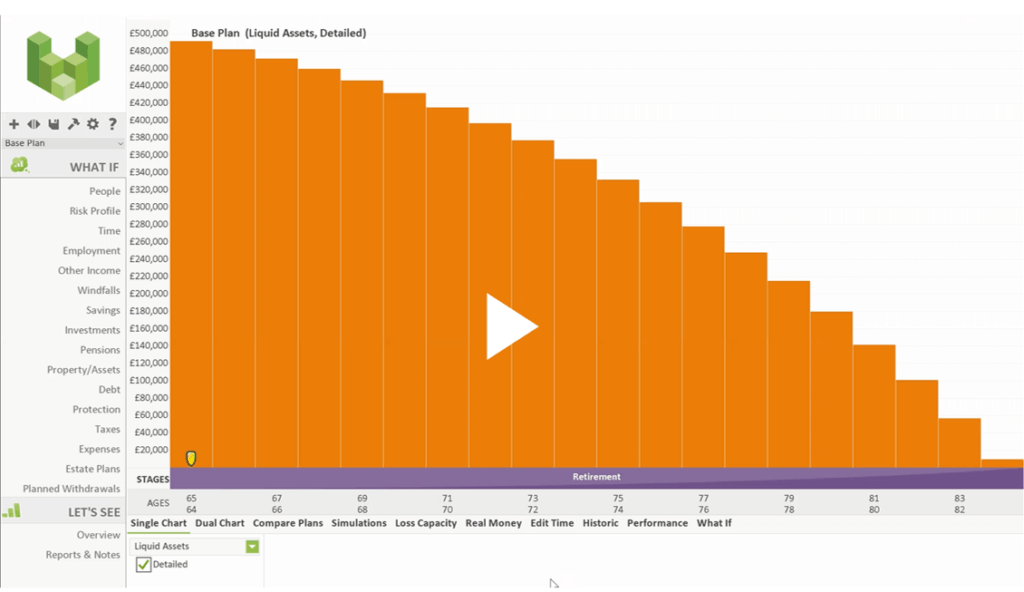

We’re often asked “how much can I spend each year from my pension fund or investments and not worry about running out of money?”

The answer, as is so often the case is… it depends.

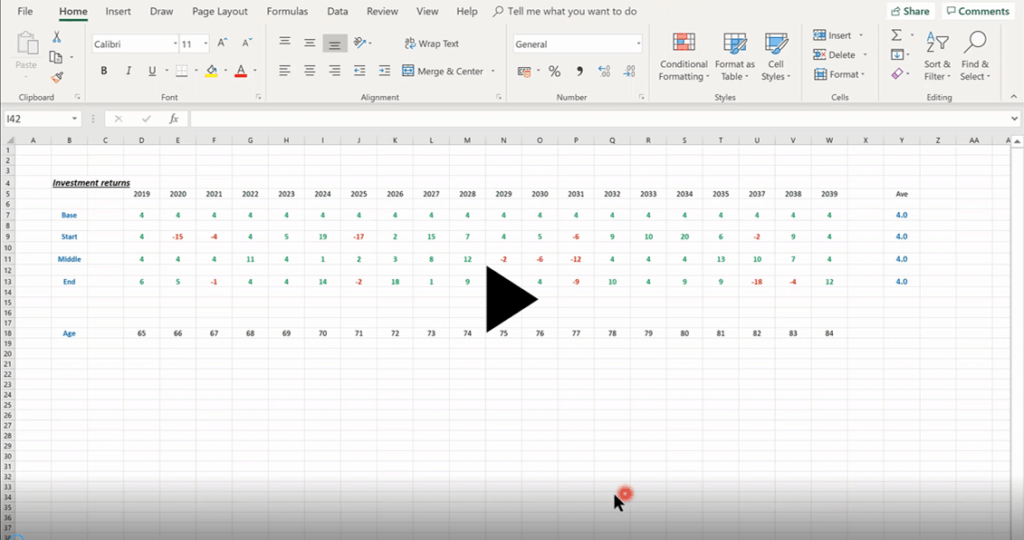

In these two audio clips we explore 1) how simply using average annual investment returns as a guide can lead to some very different outcomes. More importantly, 2) we then look at what you can do to plan and ensure you don’t run out of money.

1.How much can I safely withdraw from my pension pot?

2. What strategies can I adopt to make sure that my pension pot doesn’t run out of money?

The strategies we explain include:

-

- Level (no indexation) spending

- Spending increases only when investment returns are positive

- Level spending until pension/investment has increased by 50%

- Selective Asset sales to support spending

Should you have any questions regarding your financial planning or existing pension, then please get in touch via the contact form or call us on 01825 76 33 66.