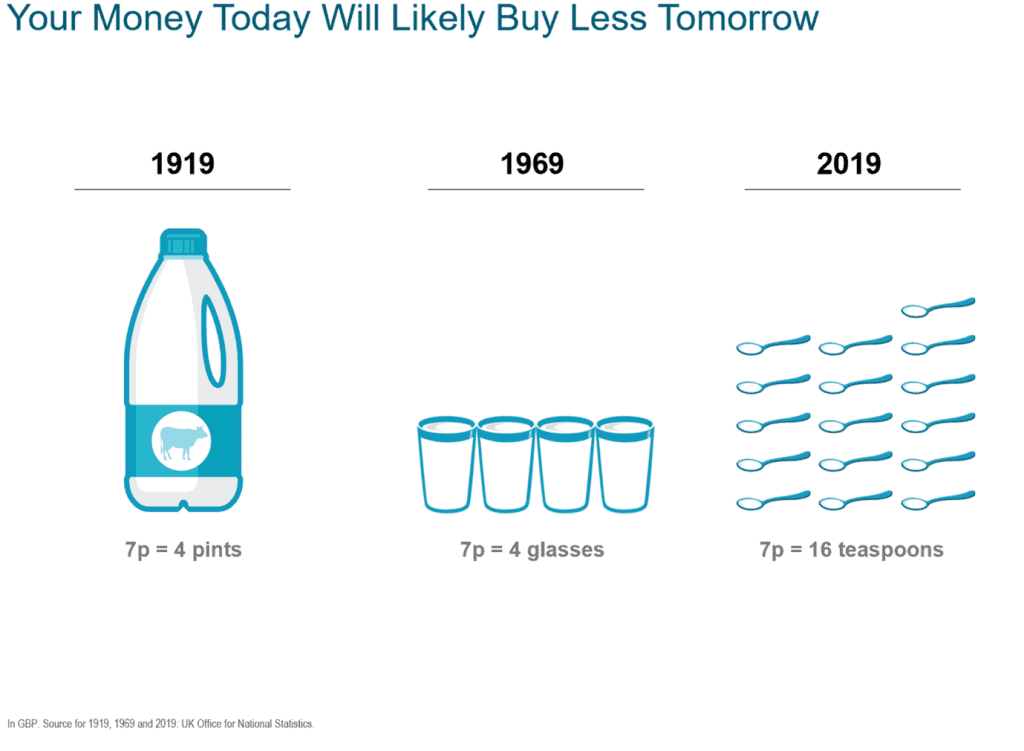

You will be familiar with the concept of inflation i.e. as overall prices increase, each pound buys fewer goods and services.

This can be illustrated by the graphic below, highlighting the long-term impact of inflation on the price of milk.

All very straightforward, but what’s the point for investors?

It’s critical to grasp the concept of ‘real’ investment returns. That is investment returns in excess of inflation. If your investment returns do not keep pace with overall price increases, then you will experience a loss of purchasing power in the future.

Again, this can best be illustrated by looking at the two graphics below. The bar chart on the left highlights the current problem for savers with interest rates likely to provide nothing close to inflation.

The chart on the right-hand side can be viewed to show the longer-term impact of any deposit or investment that doesn’t keep pace with inflation i.e. the annual return is consistently 2% lower than the general rise in goods and services.

It’s clear that after 20 years the purchasing power of your starting £100,000 is significantly lower than at outset.

Your money today will buy less tomorrow.

Why make this point?

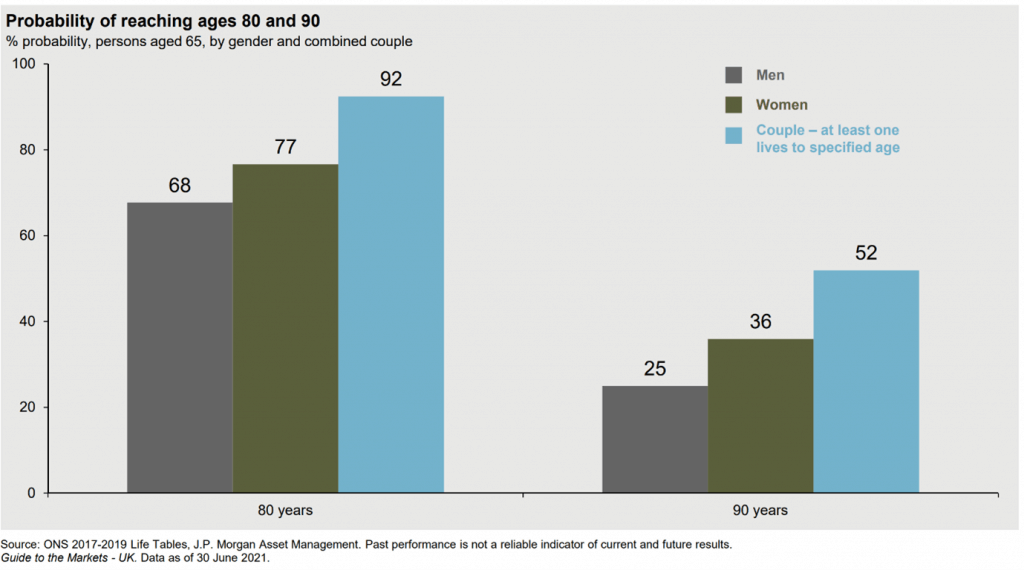

When you combine the need for ‘real’ investment returns with a look at Office for National Statistics (ONS) life expectancy data, you can further appreciate the potential impact of inflation.

Much as you may prefer not to ponder what your chances are of reaching ages 80 or 90, the sobering graphic shows the chances of one of a 65-year-old couple getting there.

A 92% chance of one party reaching 80 years old and a 52% chance of one party reaching 90 years old!

If you’d prefer a more personalised estimate of your life expectancy, use the life expectancy calculator on the ONS website.

Inflation, and its impact, can be the silent invisible risk to short-term thinkers.

If you have any questions relating to this article, please get in touch by completing the contact form below or call us on 01825 73 33 66.