If there is an Artificial Intelligence (AI) bubble, how do you invest to address this?

Let’s start with some context.

Historically, the world’s largest stockmarket (the American S&P 500 index) and its top 10 stocks have significantly influenced its direction.

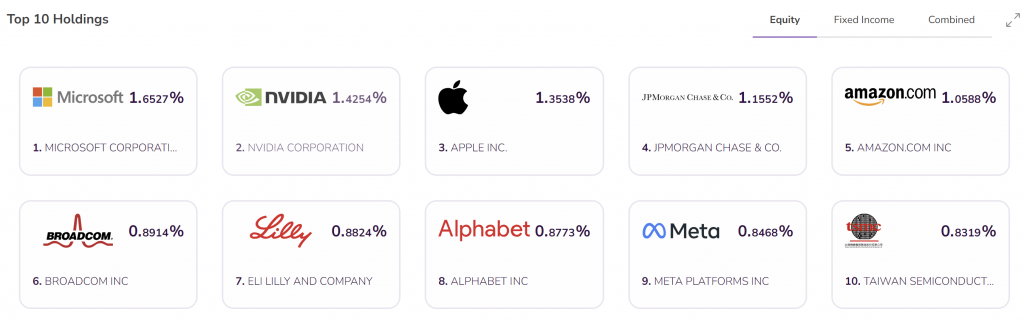

Over the last few decades, the top 10 stocks have typically accounted for around 25% of the index’s total value. However, this figure has risen closer to 35% in recent years. Currently, the five largest stocks in the Index (Microsoft, Apple, Nvidia, Alphabet, Amazon) account for 27% of the total value of the index.

This has led to speculation we are entering another investment “bubble”, specifically in companies with a particular focus on AI.

Click the image to download our investment partner ebi’s blog that reviews this in more detail and discusses how to invest to avoid becoming a victim of the next investment bubble.

If you are keen to better understand how much exposure a typical Swindells investor currently has to the five shares mentioned in the ebi blog, an overall investment portfolio comprised of 80% shares all around the world and 20% loans to governments and companies across the globe, these five companies represent approx. 6.2% of total monies invested as illustrated in this graphic.

If you have any questions relating to your investments, please get in touch on 01825 76 33 66 or via the form below.