Rathbones’ investment research threw plenty of fuel on the fire of the ‘which is better property or shares’ debate with their recent research paper “Don’t bet the house. Why the golden age of property is over”.

Whilst cynics might suggest that a company that provides investment advice to thousands would likely promote the benefits of investing in shares rather than property, their research made for interesting reading.

Equally, the old cliché “If you torture the data long enough, it will confess to anything” (Nobel laureate Ronald Coase) ought to be heeded whenever any such comparison is being made.

We’ve picked out a few key pointers below, but the full research paper can be read here.

The lost golden age of UK property investing

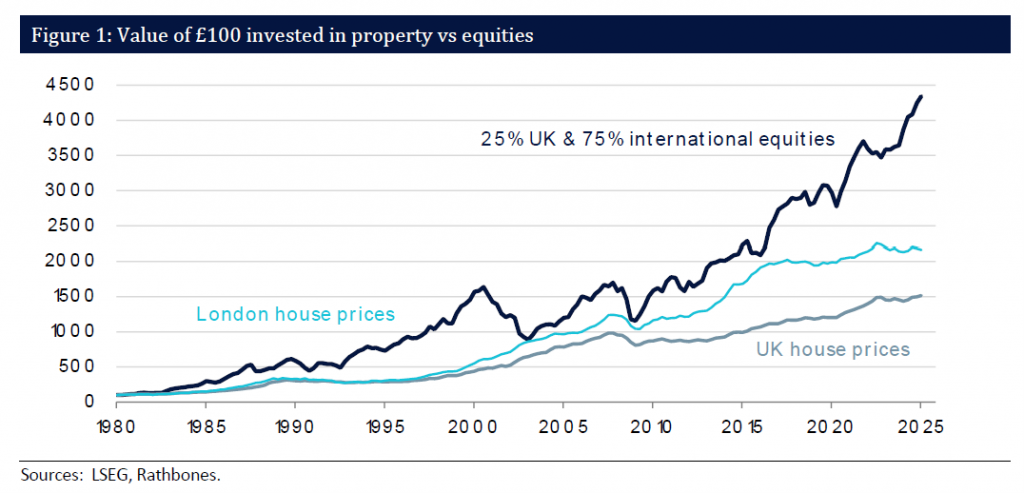

The golden age of property ownership in the UK appears to have been between 1980 and 2016 when UK house prices rose a rate of 6.7% per year, rising to 8.5 % in London, well ahead of inflation. This mostly benefitted the so-called Baby Boomer generation. Their children however lack the same opportunities.

Since 2016, house price growth has slowed sharply, higher interest rates have squeezed the buy-to-let business model, and the regulatory treatment of private landlords has become progressively less favourable.

Past performance doesn’t guarantee future returns

Many buy-to-lets, and second/additional rental properties are now rendered ‘unviable’ as businesses due to high interest rates, toughening regulation, and slowing property prices.

Higher interest rates have affected landlords too. Over half of landlords fund their rental properties with buy-to-let mortgages, with around four in five of those being interest only. For the landlords that have relied most heavily on mortgage financing, higher interest rates may even render their business model unviable.

The typical 2-year fixed 75% loan-to-value but-to-let mortgage rate has risen from below 2% a few years ago to around 4% today. Compare that to our best guess of the current average gross rental yield of just over 5% and then deduct maintenance, agency fees, insurance, and any other expenses, and it’s perfectly possible that a significant portion of buy-to-lets are unprofitable.

If you have a property portfolio and you’re questioning what your next step should be, whether that’s an investment dilemma or how to plan to reduce your current Inheritance tax liability with a property portfolio, please get in touch via the form below or call us on 01825 76 33 66.

Note:

Our thanks to Rathbones for their support with this article.

- This blog is for information purposes and does not constitute financial advice, which should be based on your individual circumstances.

- Your home may be repossessed if you do not keep up repayments on your mortgage. Think carefully before securing debts against your home.

- If property prices fall and your capital value falls below your outstanding interest-only mortgage, you’ll need to make up for any shortfall if the property sells for less.

- Not all mortgage contracts are regulated by the Financial Conduct Authority.