“You will always hate something in your portfolio. Really, really hate it”. James Osbourne (Bason Asset Management) October 2014.

We occasionally field questions from those eagle-eyed clients telling us that they have concerns with regard to one (or more) of their holdings in their portfolio, which for whatever reason are doing badly at that point. What follows is an attempt to explain why any portfolio is diversified and how (and why) this methodology works.

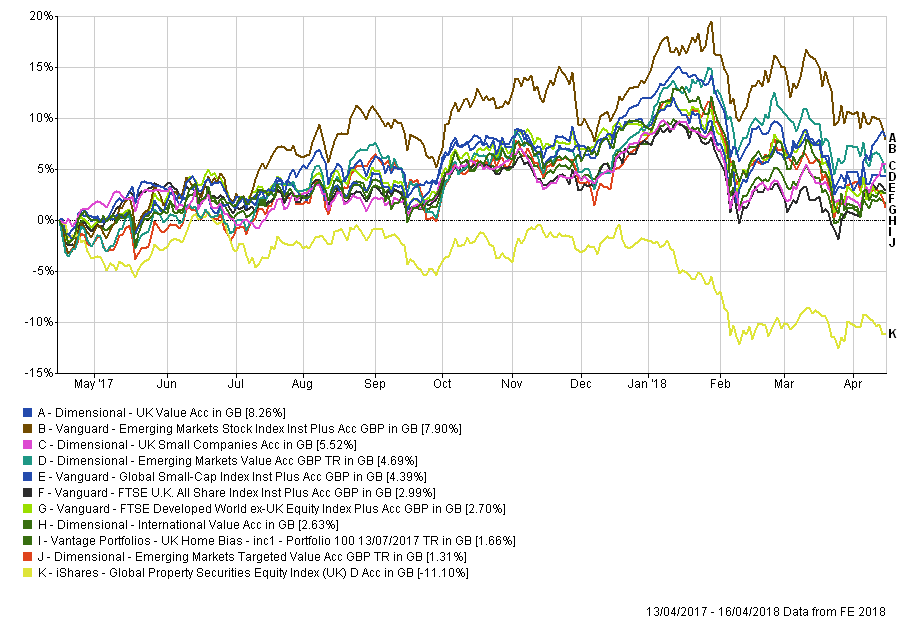

Looking at the One Year chart for all of our Equity/Growth Funds it is not hard to spot the outlier; Global Property has lagged badly in the last year (and indeed over two years as well).

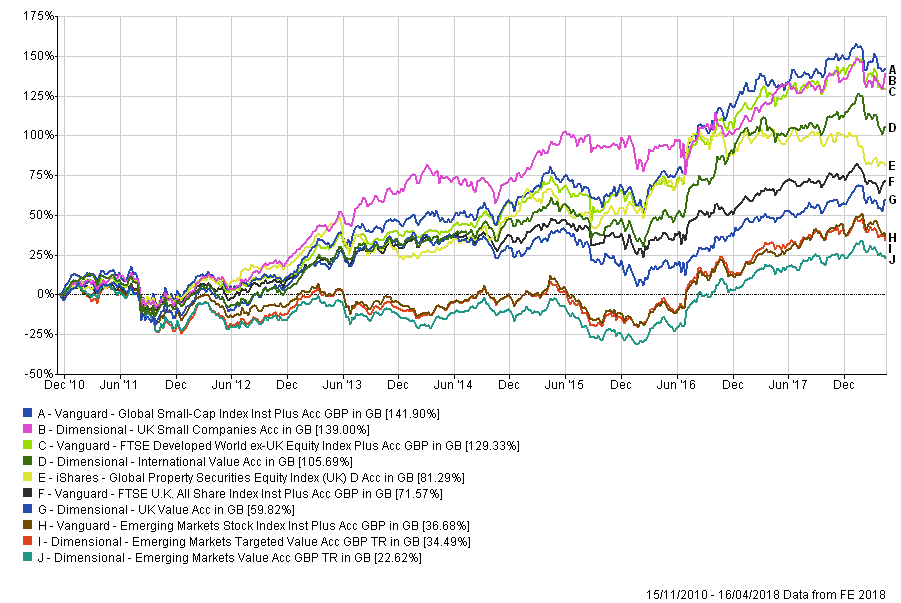

Over 10 years, however, the picture changes dramatically; over that time, Property is in the middle of the pack. The fund (and by extension, Global Property), has gone sideways since August 2016, partly as a result of the Brexit outcome, but not coincidentally, the 13th of July 2016 also marks the low in Global Bond yields (as per the Barclays Global Aggregate Bond Index); 10-year Gilt yields too reached a low point in August 2016 (at 0.52%). As of this week, UK Gilts now yield 1.49%, a two-fold increase, which has put pressure on Property prices.

Obviously, this has hurt performance (though maybe by not as much as one might imagine), but it has led to some pointed questions, so it might be a good idea to review why we have the holding and what its purpose is within the context of our portfolios. Here goes…

The main argument for Diversification, in general, is about risk reduction (however it is defined) and not about portfolio return, (which is where asset allocation comes in).

The idea is that if one asset declines there will be an offsetting rise in another (or at least a smaller fall); fixed interest/bonds, for example, tend to do better in economic declines compared to shares/equities, offsetting losses that occur in the value of the equity markets (recessions tend to see falling Corporate profits, whilst bonds benefit from the resulting Interest rate cuts). Thus, by increasing the number of (lowly or non-correlated) assets in a portfolio, one can reduce risk without sacrificing potential returns; thus, the investor is diversifying away investment risk and, in the process, improving risk-adjusted returns.

So why do we diversify?

Because not all investments perform well at the same time, as they are affected differently by the same events (inflation rises, exchange rate movements etc.) It enables the investor to build a portfolio where the combined risk of all the constituents is lower than that of the individual holdings. Diversification can be achieved by investing a large number of different shares/equities by Industry, by Region or by Asset class, as long as the different investments tend not to be affected in the same way by the same event. (If one were to invest exclusively in Banks, for example, one would be taking a big “bet” on the direction of interest rates).

Of course, over shorter time frames this may not “work”, but diversification would be unnecessary if we knew the future with complete certainty (and accuracy). Anything can (and often does) happen, and diversification alone will not allow an investor to avoid a bear market completely.

A well-structured portfolio needs to be designed with the client in mind, with special reference to risk tolerance; it is not sufficient to build one that the investor should have, but the one they will stick with. Too much (or too little) risk will cause emotional swings that tempts them to get in (or get out) at precisely the wrong time. It is not necessarily the plan that will fail, but the ability/willingness to follow it that will be the hurdle. Understanding the reasons for an asset’s inclusion in the portfolio and thus why at times it will not do so well is key to following the long-term plan. Once this is accepted, the re-balancing process (which of necessity involves buying those assets that have underperformed and selling those that have done well – a.k.a buying low and selling high) becomes second nature.

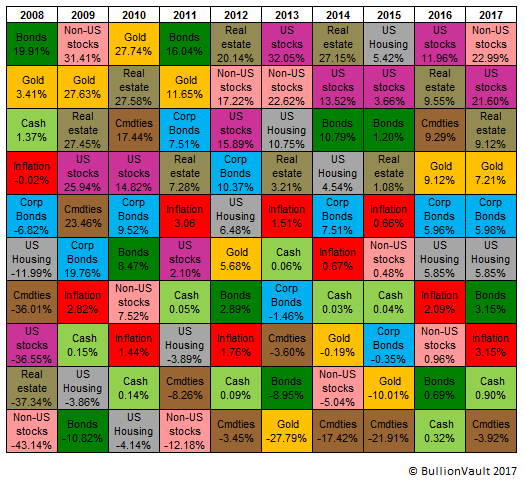

Diversification will always mean that one will do worse than the BEST asset class, but it’s not a competition, (except with oneself). The asset allocation at any given moment, therefore, is always (a bit) “wrong”, but we cannot know (or predict) what will happen in markets, so cannot avoid the “bad stuff”. The chart below shows no consistent pattern, precisely because there is none. If we bail out during bad times, we may not see the good times either.

If you have a question about the diversity of your investments, please call us on 01825 76 33 66 or get in touch by filling out the contact form.