Now that it’s been confirmed that pensions will count towards inheritance tax from April 2027, you might be wondering how to limit the tax your family could pay.

One option is to use part of your pension to buy an annuity, which turns that portion into a regular income for you instead of a taxable lump sum for your estate.

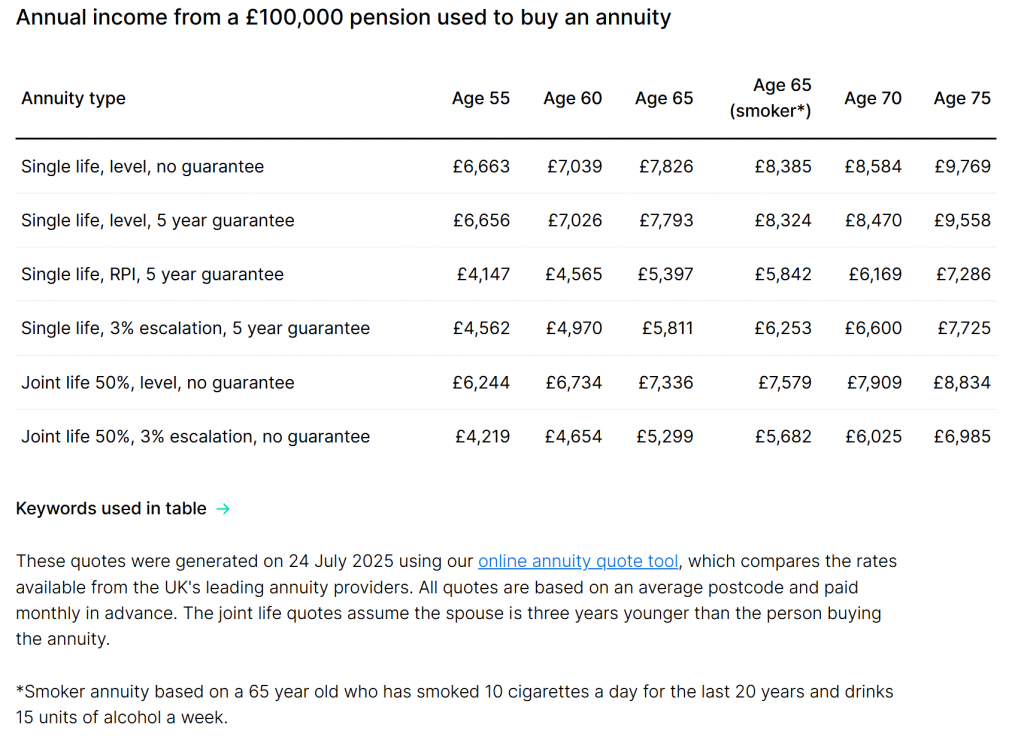

Current indicative annuity rates, courtesy of Hargreaves Lansdown, are shown below.

Clearly, advice would be required on what annuity type might be most suitable for you own situation, but the principle is one of setting up a contractually guaranteed income stream which could then be used to fund a Whole of Life Assurance policy.

What is Whole of Life Assurance?

It is a type of Life Assurance that guarantees a tax-free lump sum payout whenever you die, not just within a fixed term. They can provide the following benefits.

- They can be written into Trust, keeping it outside of your estate and potentially speeding up any payout

- Provide cash to pay HMRC part or all of any IHT due, which can be especially useful if a large proportion of your wealth is tied up in illiquid property or business assets

- Can be used alongside other IHT planning options

Guaranteed or reviewable premiums?

Whole of Life plans come with two main premium types.

- Guaranteed premiums – Stay fixed for life, no increases unless you opt for index-linking of the payout.

- Reviewable premiums – Generally, a lower starting premium but with a strong likelihood that premiums will increase sharply on review every 5/10 years.

Guaranteed premiums are typically the default choice, bu reviewable policies can be an option in certain situations.

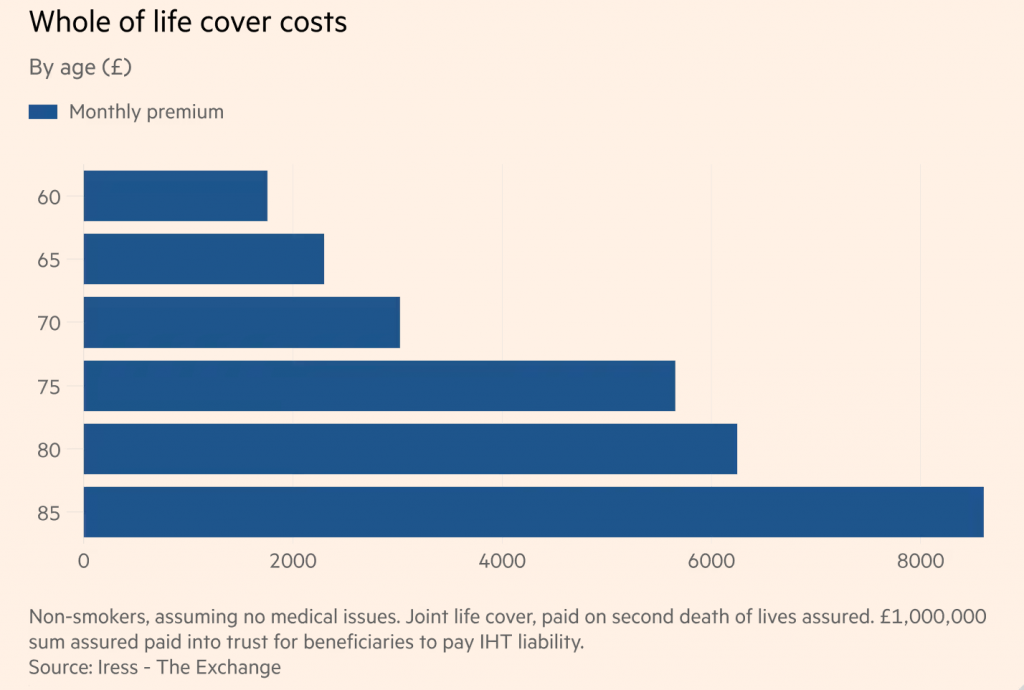

Indicative ‘Whole of life’ monthly premiums are shown below, but I would stress that policies will always need to be medically underwritten which will ultimately determine your actual premium.

If you have a question about whole of Life Assurance, or the implication of this new tax, please get in touch by completing the form below or calling us on 01825 76 33 66.

Also relevant is our previous blog Are your pension savings at risk from the new tax rules? which is an important read.