Possibly, the most frequently asked question we receive is along the lines of:

“How much can I spend from my pension/investment portfolio and remain confident that I will not run out of money”?

You may be familiar with the “4% rule”, originally researched and recommended by Bill Bengen. To clarify, Bengen proposed that investors could withdraw 4% per annum (before the deduction of any fund costs, adviser fees and transaction costs), and increase this 4% with inflation each year e.g. Assume inflation of 3% per annum, your starting 4% withdrawal would increase by 3% to 4.12% in year 2, and have a very high degree of confidence that they would not outlive their money.

His research was based on a portfolio of 50% US shares and 50% US bonds (loans to governments and companies), at the time this was viewed as the “sweet spot” allocation. Portfolios with higher allocations to shares did allow for higher starting withdrawal rates but with more uncertainty about not running out of money.

Let’s be clear, this research and our recommendation is not to build a portfolio which simply aims to produce dividends and interest of 4% per annum and the capital remains untouched.

There’s an abundance of research which confirms that this leads to very undiversified portfolios (portfolio assets are selected purely on the income they generate) and variations in the income you would receive (companies often stop or change the payments of dividends and interest)

30 years have passed since Bengen’s original research and his new book A richer retirement: supercharging the 4% rule to spend more and enjoy more , now proposes that using a more diversified 55% shares/40% bonds and 5% cash portfolio, this starting 4% withdrawal rate could be increased to 4.7% per annum i.e. Assume a £500,000 portfolio x 4.7% = £23,500 per annum

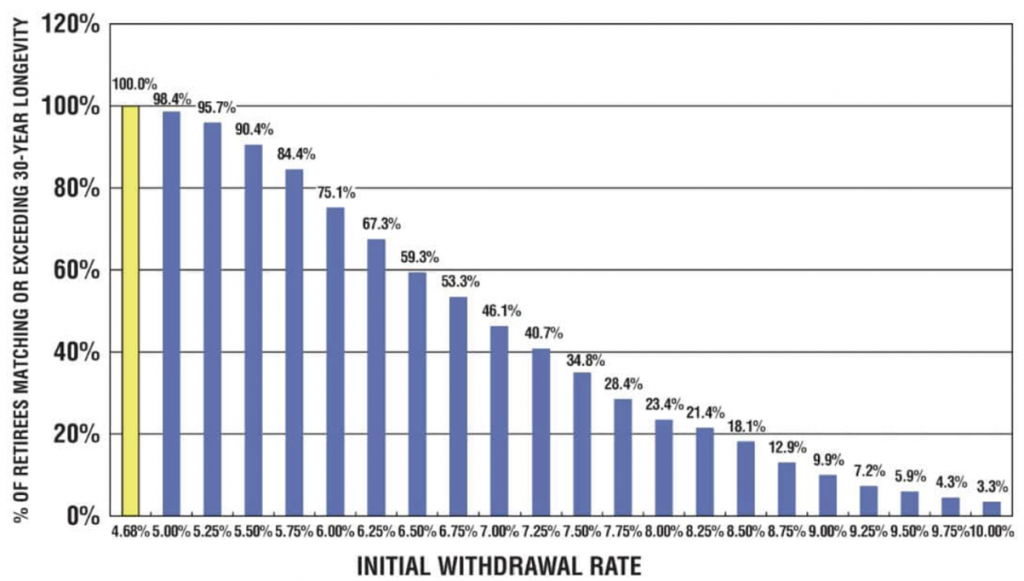

The chart below shows the percentage of investors that did not run out of money over 30 years based on initial withdrawal rates and Bengen’s revised portfolio mix. Note, not a single investor ran out of money with a 4.68% withdrawal rate (which Bengen rounds to 4.7%):

Nick Maggiulli’s brilliant article why the 5% rule is the new 4% rule proposes two conditions (both of which we agree with!) that could increase this withdrawal rate from 4.7% to 5% per annum.

- Bengen’s data and analysis are accurate and reasonable. I believe they are given the historical data and change in allocation outlined above.

- You are willing to decrease your spending during market crashes. For example, you might delay a holiday during a 20%+ downturn or reduce your spending when inflation runs hot. As this table illustrates, even with just 20% of your spending being discretionary, you can increase your withdrawal rate from 4.0% to 4.5%. Therefore, with a safe withdrawal rate of 4.7%, you could easily increase that to 5% if 20% of your spending is discretionary.

In summary, you won’t be surprised to read that our guidance on what you can safely spend and be confident you won’t outlive your money is evidenced based and grounded on some of the very best research we can access.

We recognise individuals have their own set of goals and financial objectives and this article is not proposing that all investors mirror Bengen’s more diversified and improved portfolio (55% shares, 40% bonds and 5% cash).

Arguably, with the right overall structure to your finances, pensions or investment portfolios with higher allocations to the “great companies of the world” (shares) provide better protection against the impact of inflation, higher expected (but not guaranteed!) investment returns and potentially, higher ongoing spending rates from your portfolio.

If you have a question relating to your investments, please get in touch by completing the form below or calling us on 01825 76 33 66.

Note:

-

This blog is for information purposes and does not constitute financial advice, which should be based on your individual circumstances.

-

The value of investments and any income from them can fall as well as rise. You may not get back the full amount invested.

-

Investing in shares should be regarded as a long-term investment and should fit in with your overall attitude to risk and financial circumstances.

-

Past performance is used as a guide only; it is no guarantee of future performance.