Investing internationally can bring many advantages to a portfolio

It can provide exposure to different economic cycles, inflation rates and interest rates as well as bringing increased diversification. But it also exposes you to exchange-rate risk.

Currency confusion

Sometimes, investing overseas can cause confusion when it comes to returns. Last year was a great example. The S&P 500, a key index of US shares, was up about 19%, but a UK investor in the S&P 500 only saw a return of about 9%. The previous year, things went the other way: the S&P 500 returned just over 9%, but a UK investor earned a whopping 31%!

Why the difference?

There may be many reasons. Fund costs, fees, trading costs and the gains or losses from active management are all things that can make a fund’s return differ from its benchmark. In the case of international investments, however, there’s another significant reason: currency fluctuations.

The mechanics of overseas investing

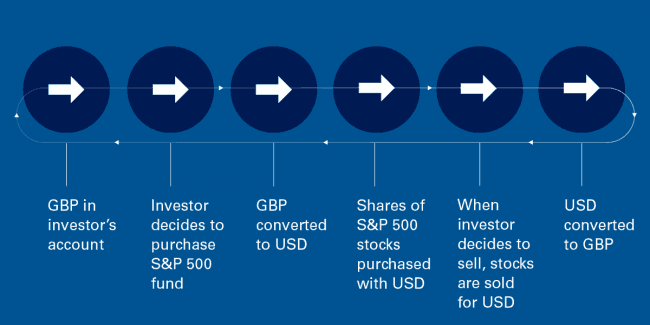

Here’s how it works. Most foreign investments are priced in their home currency, but UK investors operate in pounds sterling. So if you use pounds to purchase an investment in an overseas market in Vanguard’s Personal Investor service, the first thing we do is convert the money into the currency of the market concerned.

Using the S&P 500 as an example, we’d convert your money into US dollars before we invested it. And in the future, when you want to sell the investment, we would receive US dollars, which we would convert back into pounds before depositing them into the account.

Figure 1: Six steps to international investment

An additional source of return

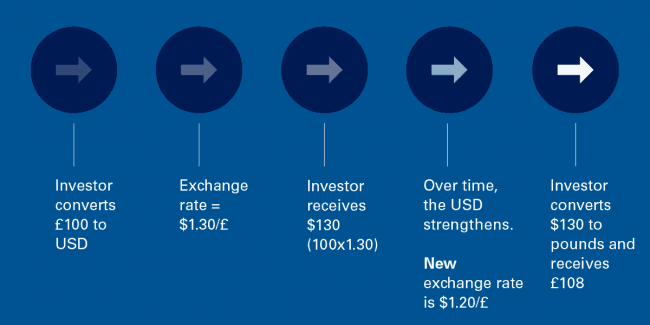

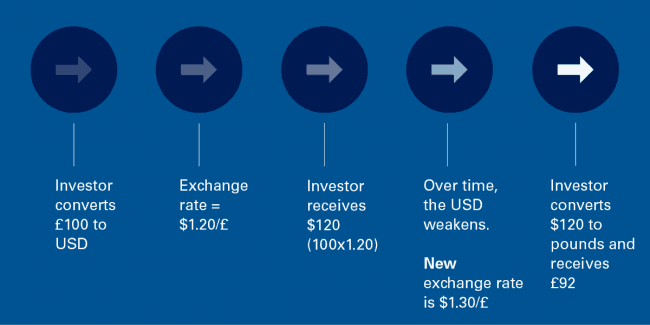

During the time the money is invested, it’s in US dollars, and the value of those dollars relative to sterling will be constantly fluctuating. That creates an additional source of return, which could be positive or negative.

If the value of the dollar increases relative to the pound, as it did in 2016, the investment will make more money, because it will return more pounds per dollar when sold. And if the dollar weakens, as it did in 2017, it will produce less because those dollars will buy fewer pounds when it’s time to sell.

Figure 2a: If the overseas currency strengthens, return is increased

Figure 2b: If the overseas currency weakens, return is decreased

We’ve used US dollars in our example, but the same principle holds for all overseas currencies.

It all evens itself out in the long run

For most long-term investors, these currency movements mean very little, because they tend to cancel out over long periods due to economic cycles. Over shorter periods of time, however, currency fluctuations can make a significant difference to portfolio returns.

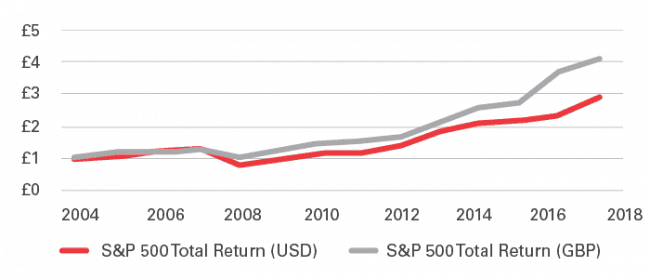

In 2017, the change in the exchange rate worked against UK investors but, in fact, the last several years have generally been good for UK investors. Since 2004, sterling investors in US equities have enjoyed cumulative gains about 30% higher than their US dollar counterparts.

Figure 3: A weak pound has been good news for sterling-based international investors

Growth of £1:

Performance of the S&P 500 Index over the past five discrete calendar years:

Returns (%) 2013 2014 2015 2016 2017

S&P 500 TR USD 32.4 3.7 1.4 12.0 21.8

S&P 500 TR GBP 29.9 20.8 7.3 33.5 11.3

Source: Vanguard calculations, using data from Morningstar, Inc. Past performance is not a reliable

indicator of future results.

This strong performance for UK investors was driven by a dramatic decline in the value of the pound relative to the dollar between 2004 and 2017, from about $1.91/£ to $1.35/£. This decline was part of a broader weakening in sterling against most major global currencies, a decline that we do not believe will be repeated over the coming years.

Key points to remember

- Investing internationally is a great way to diversify.

- Currency fluctuations mean the return on foreign investments won’t always match the index

returns. - For long-term investors, currency fluctuations are likely to cancel themselves out.

- For those who have shorter time horizons, hedging may be an option. We’ll explore this in a

future article.

If you have a question about your investments, please call us on 01825 76 33 66 or get in touch by filling out the contact form.