In the aftermath of Donald Trump’s re-election, its perhaps natural that investors consider what impact he or any President may have on stockmarkets. With the American stockmarket being so globally influential, you could be concerned about the impact this may have on your own finances.

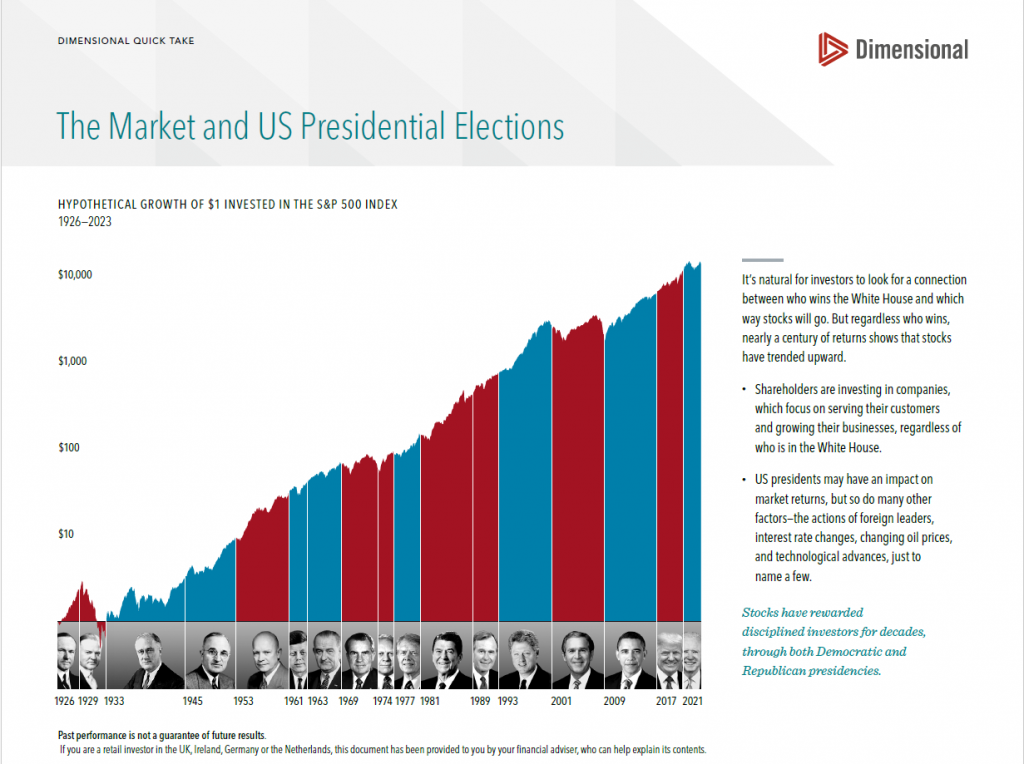

The Market and US Presidential Elections

The image below evidences what history tells us about the influence of any president, either republican or democrat, on the Market.

It’s understandable for investors to seek a connection between who wins the White House and which way shares will go. But a look at history underscores that shareholders are investing in companies, not a political party.

Furthermore, it’s important for investors to remember that whether you are optimistic or pessimistic about the future state of the world, you should be optimistic about the market.

You can read more about how Election Results Shouldn’t Dictate Your Investments by Dimensional Fund Advisors.

There are numerous factors that affect the Markets

We strongly recommend you resist the temptation for short term speculation and retain a longer-term perspective.

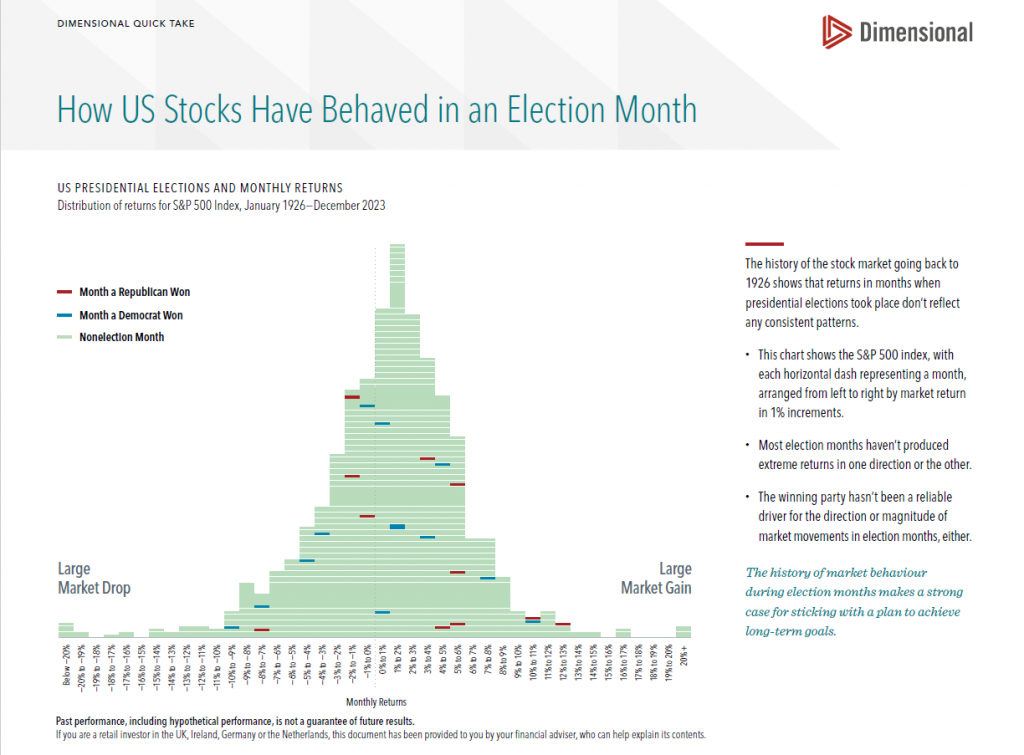

Remember Presidents are just one factor potentially affecting markets. History going back to 1926 shows stockmarket returns in months when presidential elections took place don’t reflect any consistent patterns.

And, if you’re thinking it’s a different story in the UK, it’s not! Check out How Much Impact Does The UK Prime Minister Have On Stocks from Dimensional.

Have a question or want to get in touch? Then, please complete the form below and we’ll get back to you.