The Budget on March 11th 2020 was probably more memorable for what it didn’t contain than any announcements made by the new Chancellor, Rishi Sunak.

Highlights of the Budget are contained within this downloadable document – Budget March 2020.

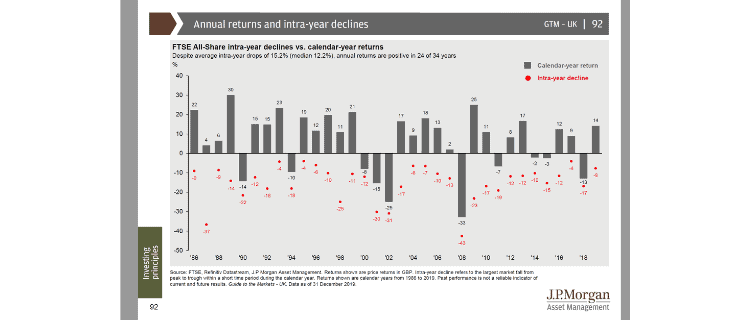

Ongoing big fluctuations in stock markets around the world remind us that this is nothing new and relatively normal.

The image below displays the declines each year in the FTSE All-Share Index during the last 24 years. Note, that in spite of the majority of years producing positive returns, the average decline is approx. 15% during the course of the year.

Sometimes it’s uncomfortable. It’s stomach churning. It’s downright painful. Scary, even. But it’s all part of the experience.

The best advice we can give at this time – do nothing.

Our portfolios are perfectly diversified and behaving in exactly the way we would expect. To use the footballing goalkeeper and penalty analogy, how many more penalties would be saved if the goalkeeper simply did nothing and stayed in the middle of his goal. Likewise, we could pretend we or someone else knows when events may worsen and when they may improve, and use this information to constantly sell/buy/sell/buy etc.But there is so little actual evidence to support investing like this, our best advice at present, “we will get through this”.

The Coronavirus impact has forced us to temporarily alter the way we communicate and meet with anyone. Until further notice, and chiefly to respect the health of you and your families, we will not be meeting face-to-face, but can use screen share technology or the phone to answer any questions or issues you may have.

Please do not hesitate to get in touch at any time if you have any concerns or questions.