Do you consider yourself a rational investor?

The start of August 2024 saw the return of some stockmarket volatility, or as we would prefer to more accurately describe it temporary declines.

Temporary declines are a normal and permanent feature of long-term investing but should not present any problem to a rational long-term investor.

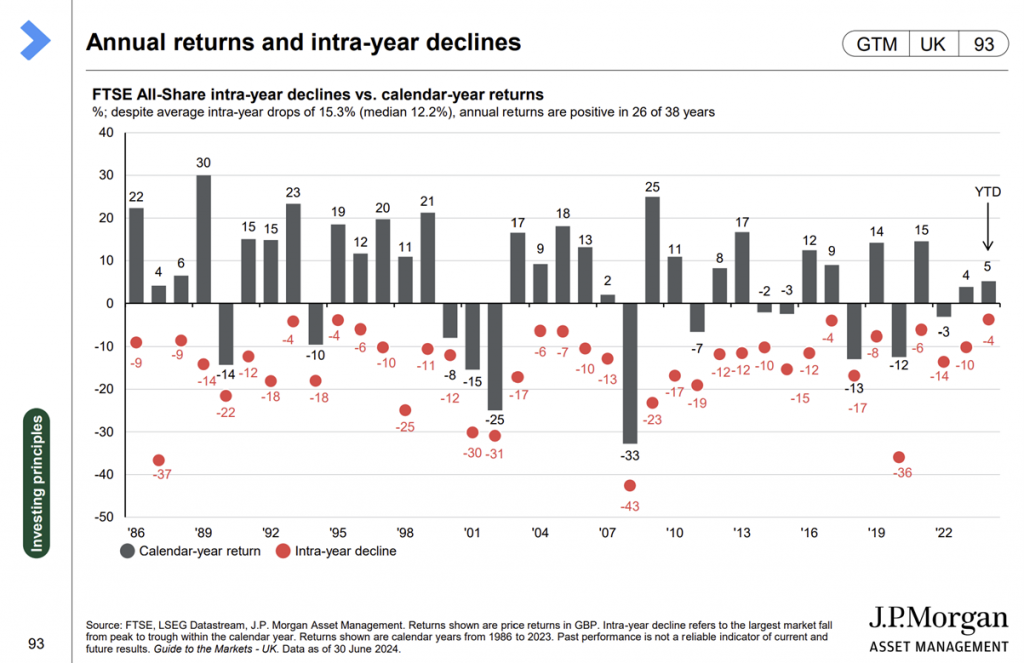

Take a look at data for the UK FTSE All-Share going back 38 years and you’ll see the average temporary decline in each year was 15.3%, despite this, annual returns were still positive in 26 of those 38 years.

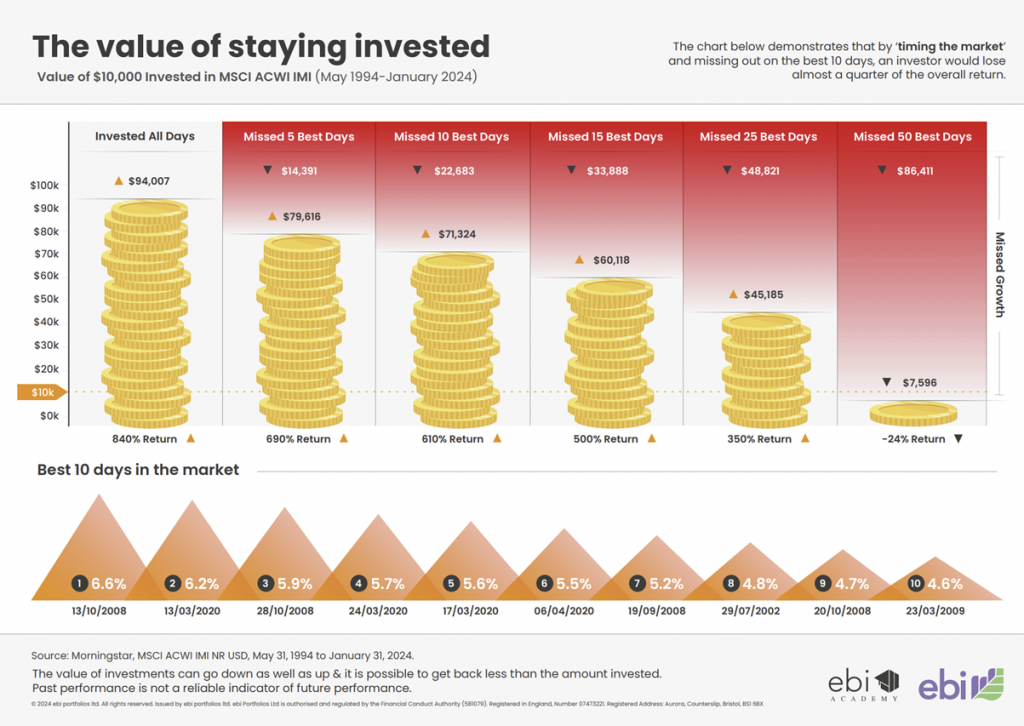

Rational longer-term investors also understand the reward for not overreacting or panicking when these temporary declines occur as you benefit from staying invested.

The image below highlights the enormous impact and benefit of staying invested and not missing some of the best stockmarket days.

Our view remains the same as previous bouts of market volatility such as in 2020.

We believe it’s near impossible to consistently effectively time the entry and exit of markets around these temporary declines, and that the vast majority of investors are best served by simply maintaining their long-term view. This will be set out in their strategic asset allocation, holding through these events and only rebalancing their portfolio as and when pre-determined tolerance thresholds are breached and indicate a rebalance is optimal.

For a more detailed insight please click on the image below to download our investment partner, ebi’s Market Update August Volatility report.

If you have any questions relating to your investments, please get in touch on 01825 76 33 66 or via the form below.