When we ask “are you a pension lifestyler”, we’re not meaning do you eat croissants in delightful Paris breakfast cafes, or do you take rides on the Italian lakes within a classic Riva wooden speedboat.

We’re questioning if you, perhaps unwittingly, hold a pension that uses “lifestyling”?

It sounds clever and personal but what is pension lifestyling?

Lifestyle pension funds, most commonly found within company pension schemes, take away the pain and angst about how you invest your pension and which asset classes you invest in e.g., shares, cash, property, bonds (fixed interest) etc.

Typically, for younger pension holder they will invest a majority of your funds in shares, targeting the “higher return” and growth that we would all desire and with pensions, for most people, being inaccessible until their mid-50s, any “temporary market declines” are financially irrelevant in the early years because of the access limitations.

As you get older, and closer to your normal retirement age (please check what you elected for), the lifestyle pension fund automatically shifts away from the supposedly riskier and higher return assets e.g., shares and funnels your investments into “safer” assets such as bonds (loans to governments and companies) and cash.

This was all very logical in the era of annuities and before pensions freedoms were introduced. The majority of pensions were simply converted into a guaranteed income stream at retirement age, with 25% of the pension fund being taken as a single tax-free cash lump sum.

However, most pension investors, and specifically those with pension funds in excess of £250,000, no longer look to follow this simple route, choosing instead to leave the pension fund invested and draw varying amounts tax efficiently from their pensions.

So, what’s the problem with pension lifestyling?

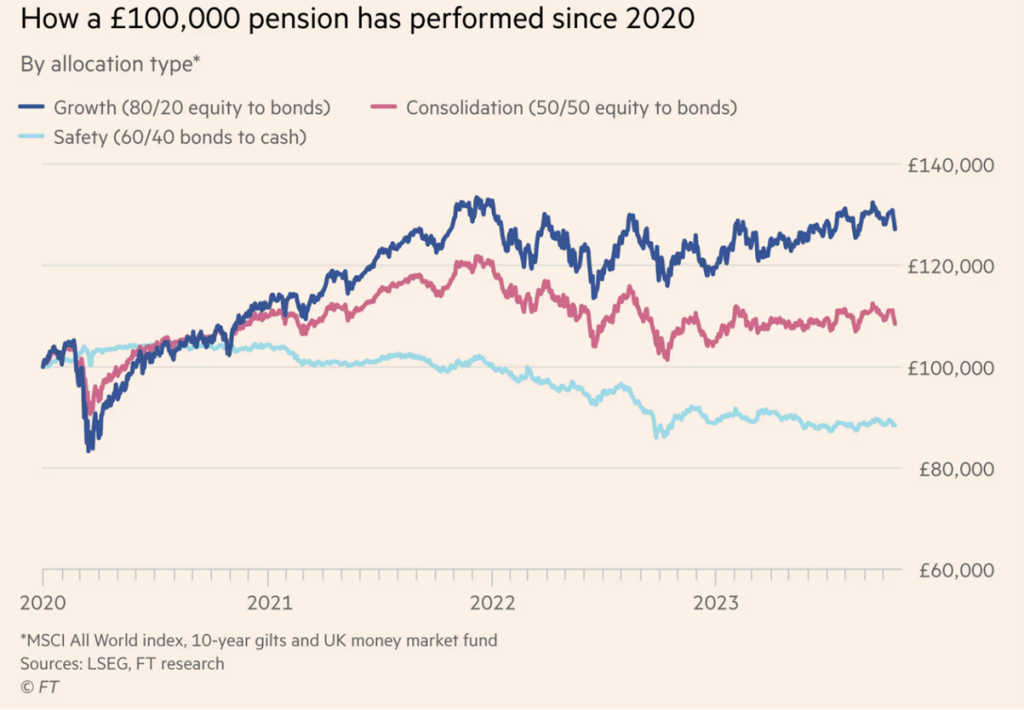

Firstly, the recent impact of rising interest rates on bonds (fixed interest) has caused their capital values to fall. Take a look at the FT data below showing the pension fund performance of three different asset mixes since 2020.

The point we’re making is many pension investors have woken up to a very nasty shock when checking on their pension values which has led, for some, to a fundamental rethink on how they live and spend funds, particularly in their early post work years.

If you are unlikely to need the certainty of an annuity for the bulk of your pension fund, moving or switching from shares to fixed interest could be inappropriate and not to say financially disadvantageous for you.

Leaving the pension fund properly diversified and invested is far more logical if you enjoy good health and you are confident about your life expectancy. You need an investment strategy that can support ongoing withdrawals and crucially, provide you with a longer-term chance that the funds will retain their purchasing power and not simply get eroded by inflation (which may happen to fixed interest and cash).

Finally, if you have an estate with a current Inheritance Tax (IHT) liability, your pension fund may well be the last asset we would recommend you access to fund your lifestyle or requirements (because of the pension funds IHT exemption). In which case, this is another reason why you might not want to move away from those assets (shares) which have proven to be the best longer-term defence against inflation.

Second Opinion Service

We often seek out more than one perspective for matters of health. The same common-sense advice can apply to financial health as well. That’s why we offer our second opinion service.

If you, your family or close friends could benefit from a fresh perspective, please let us know in the form below. Any information you share with us will be treated with the careful handling it deserves.

At a second opinion meeting, we’ll assess where you are now, where you want to go, and the best ways we see to close that gap. If you could potentially benefit from working with us, we’ll say so. If we find you are already on the right financial path, we’ll tell you that as well.

To ask a question or arrange a second opinion meeting, please complete the form below or call 01825 76 33 66.

This guide is for information purposes and does not constitute financial advice, which should be based on your individual circumstances.

A pension is a long-term investment, the value of your investment and the income from it may go down as well as up. Your eventual income may depend upon the size of the fund at retirement, future interest rates and tax legislation.

Photo of Lake Como by Chris Boland